Newsletter: Optimizing Portfolios: Simple vs. Sophisticated Allocation Strategies

How to Find the Right Portfolio Allocation: Assets or Strategies

Portfolio allocation is an important research area. In this issue, we explore not only asset allocation but also the allocation of strategies. Specifically, I discuss tactical asset and trend-following strategy allocation.

Web-only posts Recap

Below is a summary of the web-only posts I published during last week.

Do Moving Averages Add Value in Factor Investing?

Profitability of Dispersion Trading in a Less Liquid Market

Investment Strategy Diversification: What Works and What Does Not

Stock and Volatility Simulation: A Comparative Study of Stochastic Models

Dynamics of the Volatility of Volatility Index, VVIX

Are Weekend Gaps Always Filled? A Look at Stock Indices

Tactical Asset Allocation: From Simple to Advanced Strategies

Tactical Asset Allocation (TAA) is an active investment strategy that involves adjusting the allocation of assets in a portfolio to take advantage of short- to medium-term market opportunities. Unlike strategic asset allocation, which focuses on long-term asset allocation based on a fixed mix, TAA seeks to exploit market inefficiencies by overweighting or underweighting certain asset classes depending on market conditions, economic outlooks, or valuation anomalies. This approach allows investors to be more flexible and responsive to changing market environments, potentially improving returns while managing risk.

Reference [1] examines five approaches to tactical asset allocation. They are,

1. The SMA 200-day strategy, which uses the price of an asset relative to its 200-day moving average.

2. The SMA Plus strategy, which builds on the SMA 200-day by adding a volatility signal to the trend signal, dynamically adjusting allocations between risky assets and cash.

3. The Dynamic Tactical Asset Allocation (DTAA) strategy, which applies the same trend and volatility signals as SMA Plus but across the entire portfolio, rather than on individual assets.

4. The Risk Parity method, popularized by Ray Dalio’s All Weather Portfolio, equalizes the risk contributions of different asset classes.

5. The Maximum Diversification method, which aims to maximize the diversification ratio by balancing individual asset volatilities against overall portfolio volatility.

Findings

- The SMA strategy provides strong risk-adjusted returns by shifting to cash during downturns, though it may miss early recovery phases.

- SMA Plus builds on SMA by adding a more dynamic allocation approach, achieving higher returns but at a slightly increased risk level.

- The DTAA strategy yields the highest returns but experiences significant drawdowns due to aggressive equity exposure and limited risk management.

- Risk Parity and Maximum Diversification focus on stability, offering lower returns with minimal volatility, making them suitable for conservative investors.

In short, TAA based on a simple moving average still delivers the best risk-adjusted return.

This is an interesting and surprising result. Does this prove once again that simpler is better?

Reference

[1] Mohamed Aziz Zardi, Quantitative Methods of Dynamic Tactical Asset Allocation, HEC – Faculty of Business and Economics, University of Lausanne, 2024

Using Trends and Risk Premia in Portfolio Allocation

Trend-following strategies play a crucial role in portfolio management, but constructing an optimal portfolio based on these signals requires a solid theoretical foundation. Reference [2] builds on previous research to develop a unified framework that integrates an autocorrelation model with the covariance structure of trends and risk premia.

Findings

- The paper develops a theoretical framework to derive implementable solutions for trend-following portfolio allocation.

- The optimal portfolio is determined by the covariance matrix of returns, the covariance matrix of trends, and the risk premia.

- The study evaluates five well-established portfolio strategies: Agnostic Risk Parity (ARP), Markowitz, Equally Weighted, Risk Parity (RP), and Trend on Risk Parity (ToRP).

- Using daily futures market data from 1985 to 2020, covering 24 stock indexes, 14 bond indexes, and 9 FX pairs, the authors assess the performance of these portfolios.

- The optimal combination of the three best portfolios—ARP (19.5%), RP (51%), and ToRP (30%)—achieves a Sharpe ratio of 1.37, balancing traditional and alternative approaches.

- The RP portfolio, representing a traditional diversified approach, is a key driver of performance, aligning with recent literature.

- The combination of ARP and ToRP offers the best Sharpe ratio for trend-following strategies, as it minimizes asset correlation.

In the context of a portfolio optimization problem, the article solved the optimal allocation amongst a set of trend-following strategies. It utilized the covariance matrix of returns, trends, and risk premia in its optimization algorithm. The allocation scheme combined both traditional and alternative approaches, offering a better Sharpe ratio than each of the previous methods individually.

Reference

[2] Sébastien Valeyre, Optimal trend following portfolios, (2021), arXiv:2201.06635

Closing Thoughts

We have discussed both asset and strategy allocation, one advocating a relatively simple approach, while the other is more sophisticated. Each method has its advantages, depending on the investor's objectives and risk tolerance. A well-balanced portfolio may benefit from integrating both approaches to achieve optimal performance and diversification.

Educational Software

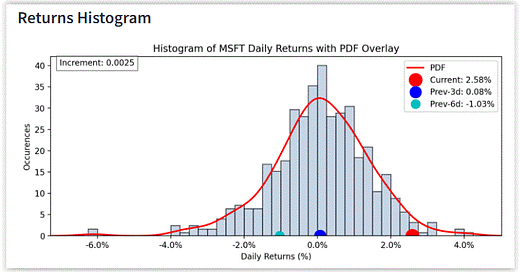

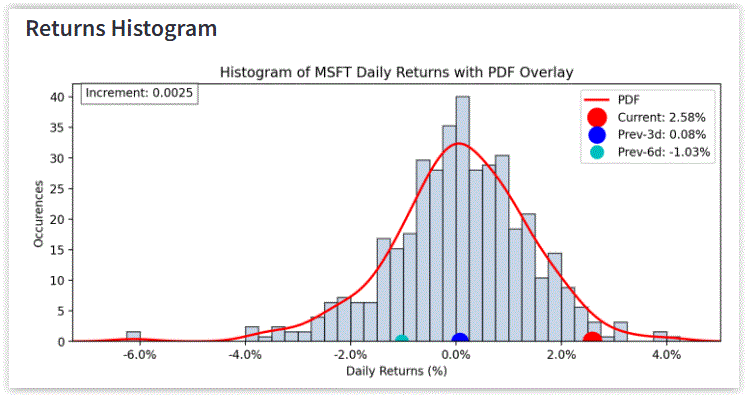

Visualizing Returns

The following app, developed by Prof. Pankaj Agrrawal, allows you to visualize the returns of any stock, ETF, or fund. It also displays returns versus total returns. In financial media, returns are often shown without accounting for dividends.

Click on the link below or on the image.

Use the app and let me know if the stock returns follow a normal distribution.

Around the Quantosphere

-The Week the Smart Money Got Whipsawed by the Market (WSJ)

-RIP quant-father Barr Rosenberg (ft)

-JPMorgan Quant-Cloning Factory Churns Out $100 Billion of Trades (yahoo finance)

-CBOE Plans Options Product for Traders Wary of Stocks Concentration Risk (bloomberg)

-Hedge Funds Paying Up to $1 Million for Weather Modelers (Yahoo finance)

-This hedge-fund style ETF is aimed at investors looking to diversify in volatile markets. Here's what to look for (morningstar)

Recent Newsletters

Below is a summary of the weekly newsletters I sent out recently

-Capturing Volatility Risk Premium Using Butterfly Option Strategies (9 min)

-Understanding Mean Reversion to Enhance Portfolio Performance (9 min)

-Volatility Risk Premium: The Growing Importance of Overnight and Intraday Dynamics (12 min)

-Exploring Credit Risk: Its Influence on Equity Strategies and Risk Management (9 min)

-Hedging Efficiently: How Optimization Improves Tail Risk Protection (8 min)

Refer a Friend

If you like this newsletter, then help us grow by referring a friend or two. As a token of appreciation, we'll send you PDFs that include links to our blog posts about financial derivatives, time series analysis and trading strategies, along with the accompanying Excel files or Python codes.

1 referral:

https://harbourfronts.com/wp-content/uploads/2024/12/fin_deriv-1.gif

2 referrals:

https://harbourfronts.com/wp-content/uploads/2024/12/risk_trading.gif

Use the referral link below or the “Share” button on any post.

Disclaimer

This newsletter is not investment advice. It is provided solely for entertainment and educational purposes. Always consult a financial professional before making any investment decisions.

We are not responsible for any outcomes arising from the use of the content and codes provided in the outbound links. By continuing to read this newsletter, you acknowledge and agree to this disclaimer.

"In short, TAA based on a simple moving average still delivers the best risk-adjusted return."

Simplicity is the ultimate sophistication.