Newsletter: Stock-Bond Correlation, What Drives It and How to Predict It

How to Understand and Anticipate Correlation Dynamics

The correlation between stocks and bonds plays a crucial role in portfolio allocation and diversification strategies. In this issue, I discuss stock-bond relationships, the factors that influence their correlation, and techniques for forecasting it.

Web-only posts Recap

Below is a summary of the web-only posts I published during last week.

Issues with Cointegration in Pairs Trading

Evaluating Mutual Fund Performance

How Overfitted Trading Strategies Perform Out-of-Sample

VIX vs. SPX Options: Skewness, Term Structure, and Hedging Implications

Improving Pairs Trading Profitability

Term Structure of Expected Stock Returns

What Influences Stock-Bond Correlation?

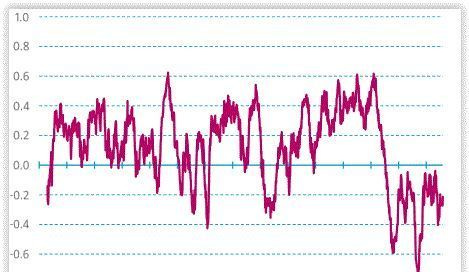

Correlation between stocks and bonds is crucial for portfolio allocation and diversification, but this correlation can vary over time due to factors like inflation and real returns on short-term bonds.

Reference [1] conducts a study on stock-bond correlation spanning an extended timeframe. Their findings indicate that contrary to conventional assumptions, stock-bond correlation generally tends to exhibit a positive or near-zero relationship. Exceptions, where the correlation drops below -0.2, were notably observed during the early 1930s, the late 1950s, and most of the 2000s.

Findings

-The correlation between stock and bond returns is a key component in asset allocation decisions. This correlation is not stable and can vary significantly over time, affecting how portfolios should be constructed.

- The recent market environment has shown that stock-bond correlation can turn positive, potentially impacting diversified portfolios negatively.

- The article suggests that contrary to conventional assumptions, stock-bond correlation generally tends to be positive or near-zero.

- Exceptions to positive correlation occurred during the early 1930s, late 1950s, and most of the 2000s.

- Factors such as inflation, real returns on short-term bonds, and uncertainty surrounding inflation play pivotal roles in determining the direction and strength of stock-bond correlation.

- Time variation in stock and bond volatility can also affect the impact of stock-bond correlation.

- Bond risk premia are positively correlated with estimates of the stock-bond correlation.

- The correlation between stocks and bonds can significantly fluctuate over time and across countries.

In short, the correlation between stocks and bonds can significantly fluctuate over time. Factors such as inflation and real returns on short-term bonds, along with the associated uncertainty regarding inflation, play pivotal roles in determining both the direction and strength of the stock-bond correlation.

Reference

[1] Molenaar, Roderick and Senechal, Edouard and Swinkels, Laurens and Wang, Zhenping, Empirical evidence on the stock-bond correlation (2023), SSRN 4514947

Forecasting Short-Term Stock-Bond Correlation

Reference [2] employs a country’s Correlation Outlook, Prospective Inflation Volatility, the Yield Curve Momentum Regime, and the Trailing 3-month stock-bond correlation to build a predictive model.

Findings

-This paper extends a macroeconomic framework that explains long-term changes in stock-bond correlation.

-Prior research explains around 70% of the variation in 10-year rolling stock-bond correlations using the relative volatility and correlation of growth and inflation.

-The authors shift focus to forecasting short-term (three-month) variations in stock-bond correlation.

-Their method uses indicators based on whether individual forecasters expect stock and bond markets to move in the same or opposite directions.

- This approach improves the ability to forecast stock-bond correlations over tactical, short-term horizons.

This paper complements previous work by focusing on short-term horizons, showing that detailed forecast data can help predict high-frequency changes in stock-bond correlation. It also highlights the value of granular forecast data, especially the correlation between responses, which may be missed in standard survey summaries.

Reference

[2] Flannery, Garth and Bergstresser, Daniel, A Changing Stock-Bond Correlation: Explaining Short-term Fluctuations (2023). SSRN 4672744

Closing Thoughts

As we have seen, stock-bond correlation plays a crucial role in portfolio management and asset allocation. We have discussed how this correlation shifts over time, influenced by macroeconomic factors such as inflation and growth volatility, and how it can be forecasted. Accurately anticipating these shifts enables more informed portfolio construction and risk management.

Educational Podcast

Why Stocks and Bonds Are Not Inherently Diversifying

Most investors are accustomed to stocks and bonds being negatively correlated and offering strong diversification. However, this relationship is not stable and can reverse, particularly when loose fiscal and monetary policies lead to inflation that exceeds expectations. In this podcast, Bridgewater’s Daily Observations Editor Jim Haskel and Senior Portfolio Strategist Jeff Gardner examine the underlying cause-and-effect dynamics.

Around the Quantosphere

-The hardest (and easiest) internships to get in investment banking (efinancialcareers)

-The average hedge fund professional earns way more than you, works way less (efinancialcareers)

- Multistrategy Hedge Funds Turn a Rocky April Into More Gains (Bloomberg)

-Multi-strategy hedge funds were the top performers in Q1 with a [gain] of 4.7%: hedge fund news (opalesque)

-Tariff-induced volatility caused spike in derivative-related margin calls, data shows (reuters)

-Bitcoin and S&P 500 Decoupling: Quantitative Macro Analysis Reveals Shift in BTC Correlation Drivers 2025 (blockchain)

-Why Stocks Appreciate Much More Overnight Than During Trading Hours (forbes)

Recent Newsletters

Below is a summary of the weekly newsletters I sent out recently

-Profitability of Dispersion Trading in Liquid and Less Liquid Environments (10 min)

-Machine Learning in Financial Markets: When It Works and When It Doesn’t (10 min)

-Do Calendar Anomalies Still Work? Evidence and Strategies (10 min)

-Catastrophe Bonds: Modeling Rare Events and Pricing Risk (10 min)

-Breaking Down Volatility: Diffusive vs. Jump Components (10 min)

Refer a Friend

If you like this newsletter, then help us grow by referring a friend or two. As a token of appreciation, we'll send you PDFs that include links to our blog posts about financial derivatives, time series analysis and trading strategies, along with the accompanying Excel files or Python codes.

1 referral:

https://harbourfronts.com/wp-content/uploads/2024/12/fin_deriv-1.gif

2 referrals:

https://harbourfronts.com/wp-content/uploads/2024/12/risk_trading.gif

Use the referral link below or the “Share” button on any post.

Disclaimer

This newsletter is not investment advice. It is provided solely for entertainment and educational purposes. Always consult a financial professional before making any investment decisions.

We are not responsible for any outcomes arising from the use of the content and codes provided in the outbound links. By continuing to read this newsletter, you acknowledge and agree to this disclaimer.