An extreme loss event in the stock market refers to a sudden and significant decline in stock prices, often resulting from unexpected and severe market conditions. These events, also known as market crashes or financial crises, can be triggered by a variety of factors including economic downturns, geopolitical tensions, natural disasters, or systemic failures within the financial system.

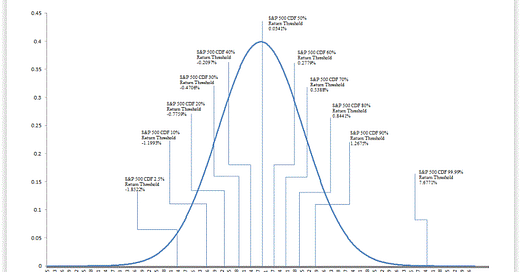

Reference [1] studies the returns of US stocks after they suffer an extreme loss event. It defines an extreme loss event as a negative return lower than 97.5% of a given asset’s daily returns. The authors pointed out,

This study analyzes the daily returns of 2,651 equities in the Russell 3000 Index continuously traded between January 2, 1950, or the date of the IPO, and early 2019. We examine extreme loss events for assets in our sample, which we define as a negative return lower than 97.5% of this asset’s daily returns.

This study finds that the average extreme loss is -8.2105%…However, on average, we observe that the equities realize a daily return of 0.8459% on the first day after an extreme loss event and a cumulative return of 1.8099% during five trading days after the event that counts for only 20.23%, i.e., 1.8099%/8.9445%, of the full recovery.

The gradual and partial recovery from the extreme loss suggests that overreaction and a panic sentiment explain approximately 20% of the loss and that extreme losses are mainly due to materialized reasons for the revaluation of the asset…

The results strongly support an extremely negative loss reversal strategy. Investors can profit if they buy an asset on the day of its extreme loss event, right before the market closes, then sell it within five trading days when the market closes. On average, this strategy can generate a daily return of 0.8459% during the first trading day, and 1.8099% in total during five trading days after entering the position.

In short, stocks usually recover after an extreme loss event, and a winning trading strategy can be designed to exploit this tendency. Furthermore, the instant loss on the event day is caused by investors’ overreaction (20%) and revaluation (80%) of the asset.

Let us know what you think in the comments below.

Vahid Asghariand and his team at Academic Quant Lab have replicated the strategy presented in this paper. The results and codes can be found here.

References

[1] X. Guo, H. Dong, and G. A. Patterson, Equity Returns Around Extreme Loss: A Stochastic Event Approach, American Business Review, May 2024, Vol.27(1) 207 – 220

https://www.researchgate.net/publication/380679034_Equity_Returns_Around_Extreme_Loss_A_Stochastic_Event_Approach

Disclaimer

This newsletter is not investment advice. It is provided solely for entertainment and educational purposes. Always consult a financial professional before making any investment decisions.

We are not responsible for any outcomes arising from the use of the content and codes provided in the outbound links. By continuing to read this newsletter, you acknowledge and agree to this disclaimer.

Interesting article and paper. I find this to be quite common anecdotally from observing markets over the years. It's a dead cat bounce so to speak. I presume managers take advantage of this to some extent within their strategies. It's a long period of time (1950-2019) so I wonder whether the later portion of the period under study has exhibited less opportunity.

As a retail investor I take advantage of this phenomenon on the options side by selling cash-secured puts on stocks that I perceive to be overvalued but would like to own at lower prices - if my thesis remains intact post-event. The extreme loss provides a double benefit in the option premium from the higher IV plus the lower share price.