The Rise of 0DTE Options: Cause for Concern or Business as Usual?

0DTE Options Are Gaining Popularity—Do They Impact Market Stability?

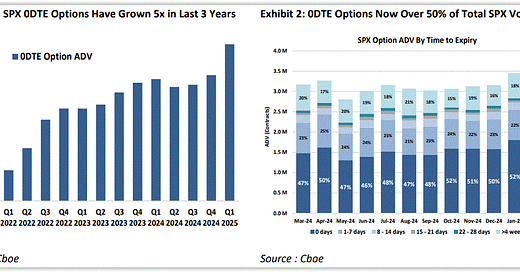

Zero DTE (Days to Expiration) options are contracts that expire on the same day they are traded. They were introduced in 2022 and have been gaining popularity. In this issue, I discuss their impact on the market and how options traders use them.

Web-only posts Recap

Below is a summary of the web-only posts I published during last week.

Bitcoin Trend Following Strategies vs. Traditional Indices: A Comparative Study

Enhancing Market Timing Strategies Through the Use of Macroeconomic Indicators

Momentum in the Option Market, Part 2

Trading VIX Futures Using Machine Learning Techniques

Reducing Path Dependency in Options PnL

Modeling Short-term Implied Volatilities in the Heston Stochastic Volatility Model

Impact of Zero DTE Options on the Market

Zero DTE (0DTE) options, also known as “same-day expiration” options, are financial derivatives with expiration dates on the same day they are traded. These options offer traders the opportunity to profit from short-term price movements in the underlying asset.

The increase in the trading volume of 0DTE options has sparked various concerns among market participants and prompted intense discussions in the media. The main concern revolves around the potential destabilization of the underlying market due to large open positions in 0DTE and other short-term options.

Reference [1] examines whether 0DTE options significantly impact the market.

Findings

-The study finds no evidence that higher 0DTE options open interest gamma increases underlying index volatility; rather, it is linked to reduced intraday volatility levels.

-Volatility effects associated with 0DTE options do not extend into overnight sessions or impact lagged intraday volatility, suggesting limited temporal propagation.

-Positive shocks in 0DTE trading volume are followed by increased underlying market trading activity, although these effects are short-lived and not economically meaningful.

-Recent structural changes in the market have made underlying returns more sensitive to 0DTE trading volume shocks, yet the overall effect size remains minimal.

-The increased trading volume in 0DTE options does not lead to destabilizing market behaviors, challenging prevailing concerns in financial media and among market participants.

-On average, the difference in market response to 0DTE trading volume between earlier and more recent periods is only 0.1 standard deviations of absolute returns, indicating economic insignificance.

-Aggregate gamma in 0DTE options is inversely correlated with realized intraday volatility, suggesting a stabilizing rather than destabilizing influence on short-term market movements.

-The volatility risk premium associated with 0DTE options is notably high, reflecting the elevated compensation demanded by sellers for bearing short-term option risk.

-Contrary to expectations, 0DTE options do not amplify market moves through delta-hedging activity, despite their high gamma and rapid decay characteristics.

-The findings support the view that 0DTE options trading can coexist with stable market conditions, especially when managed within a robust market infrastructure.

In short, the paper concludes that 0DTE options do not destabilize the market. The increase in volume has an insignificant influence.

Reference

[1] Dim, Chukwuma, and Eraker, Bjorn and Vilkov, Grigory, 0DTEs: Trading, Gamma Risk and Volatility Propagation (2024).

Risk, Timing, and Strategy: Key Differences in 0DTE Options Trading Styles

The previous paper discussed the impact of 0DTE options on the market, drawing from both practitioner insights and academic literature. Both sources point to the conclusion that 0DTE options have little or almost no impact on the market; they do not increase market volatility, contrary to what many investors have argued.

The CBOE recently updated its report [2] with new data, which reconfirmed that 0DTE options have little or no impact,

Findings

-Updated CBOE data confirms that zero-DTE options have minimal impact on market volatility, countering common concerns that high trading volumes lead to destabilization.

-The market risk from zero-DTE options depends on the balance of buying and selling, rather than the notional trading volume, which is typically well-distributed.

-SPX zero-DTE options show balanced flow between puts and calls, keeping the put/call ratio near one, unlike non-0DTE options, which are more skewed toward hedging.

-Due to this balanced flow, net gamma exposure from zero-DTE options remains minimal, reducing concerns about market maker-driven volatility.

-Both institutional and retail investors use zero-DTE options for tactical bets and systematic yield strategies, highlighting their broad appeal and diverse applications.

-Institutional investors prefer vertical spreads and tend to initiate trades earlier in the day, maintaining positions longer, suggesting greater risk capacity or hedging alternatives.

-Retail traders are more active during the market open and close, often engaging in complex strategies like iron condors and butterflies, reflecting hands-on risk management.

-The intraday behavior of retail traders—frequent opening and closing of positions—implies lower risk tolerance and a more active trading style.

-Despite using similar option structures, institutional and retail investors differ significantly in execution timing and approach to managing market exposure.

-The findings underscore that strategy similarity does not equate to identical trading behavior, with risk management practices and timing being key differentiators between investor types.

The report highlights that while the strategies are broadly similar, the approach to timing and risk management differs meaningfully between institutional and retail investors.

Reference

[2] 0DTEs Decoded: Positioning, Trends, and Market Impact, CBOE, May 2025

Closing Thoughts

The research and insights from both academia and CBOE confirm that zero DTE options do not destabilize markets, despite growing volumes and media attention. The key factor is the balanced dynamic of SPX 0DTE flows between buyers and sellers, which minimizes net gamma exposure and reduces market impact. While retail and institutional investors differ in timing and strategy preferences, their overall usage remains systematic and diversified.

Educational Video

Theta Decay of Zero DTE Options

In this video, the Tastytrade hosts broke down how time of day and market volatility impact Theta decay in 0 DTE options. They showed that most premium decay happens in the final hours, especially on low-volatility days, while large expected moves cause quicker early decay. The key takeaway is that 0 DTE options decay nearly 100 times faster than standard trades, making them appealing but risky tools. Understanding timing and position size is essential for prudent, strategic trading.

Around the Quantosphere

-Jane Street's Banned Strategy: Exploiting Liquidity Gaps and the Risks of Regulatory Arbitrage (AInvest)

-Morning Coffee: The critical questions at multistrategy hedge fund interviews. The sweaty summer of jobless millionaires from financial services (Efinancialcareers)

-How You Get and Actually Keep a Job at a Multi-Start Hedge Fund (Bloomberg)

-How to get jobs and internships at top hedge funds like Citadel and Point72 (Bundle)

-FF Podcast: 26 Degrees’ James Alexander on Hedging, Volatility, and 24-Hour Markets (Financefeeds)

-The AI Revolution in Quant Trading: Why Man Group’s AlphaGPT is the Future of Alpha Hunting (ainvest)

-Institutional investors, wealth managers and hedge funds are increasingly focusing on crypto (opalesque)

-Mysterious Option Trades Put Spotlight On Key Indian Stock Index (ndtvprofit)

-Single‑Stock ETFs Lure US Retail Traders With High‑Risk Funds(bloomberg)

-Hedge funds in first half of 2025: Humans beat machines (fnlondon)

Recent Newsletters

Below is a summary of the weekly newsletters I sent out recently

-How Machine Learning Enhances Market Volatility Forecasting Accuracy (11 min)

-Predicting Corrections and Economic Slowdowns (11 min)

-Rethinking Leveraged ETFs and Their Options (12 min)

-Using Skewness and Kurtosis to Enhance Trading and Risk Management (10 min)

-Gold Ratios as Stock Market Predictors (11 min)

Refer a Friend

If you like this newsletter, then help us grow by referring a friend or two. As a token of appreciation, we'll send you PDFs that include links to our blog posts about financial derivatives, time series analysis and trading strategies, along with the accompanying Excel files or Python codes.

1 referral:

https://harbourfronts.com/wp-content/uploads/2024/12/fin_deriv-1.gif

2 referrals:

https://harbourfronts.com/wp-content/uploads/2024/12/risk_trading.gif

Use the referral link below or the “Share” button on any post.

Disclaimer

This newsletter is not investment advice. It is provided solely for entertainment and educational purposes. Always consult a financial professional before making any investment decisions.

We are not responsible for any outcomes arising from the use of the content and codes provided in the outbound links. By continuing to read this newsletter, you acknowledge and agree to this disclaimer.