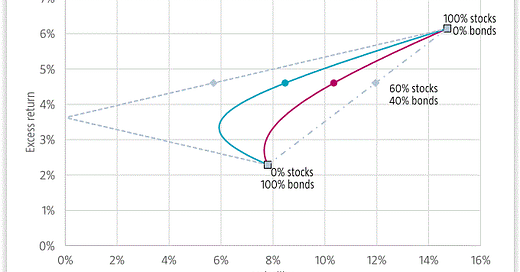

The correlation between stocks and bonds plays a crucial role in portfolio allocation and diversification strategies. This correlation measures the degree to which the returns of these two asset classes move in relation to each other. When stocks and bonds exhibit a negative correlation, it implies that they tend to move in opposite directions during various market conditions. This characteristic can be strategically leveraged in portfolio management. Investors often allocate a portion of their portfolios to bonds to provide stability and act as a hedge when stock markets experience turbulence.

The diversification benefits of this negative or low correlation can help reduce overall portfolio risk, as losses in one asset class may be offset by gains in the other. However, the recent market environment has demonstrated that stock-bond correlation can turn positive, potentially resulting in detrimental impacts on diversified portfolios.

Reference [1] conducted a study on stock-bond correlation spanning an extended timeframe. Their findings indicate that contrary to conventional assumptions, stock-bond correlation generally tends to exhibit a positive or near-zero relationship. Exceptions, where the correlation drops below -0.2, were notably observed during the early 1930s, the late 1950s, and most of the 2000s.

The authors also pointed out,

First, we observe that the stock-bond correlation varies considerably over time and across countries, both in magnitude and sign.

Second, we observe that before the 1950s, realized real returns on short-term bonds and inflation had no discernable impact on the stock-bond correlation. Since the 1950s and the introduction of contracyclical monetary policies, we find remarkably similar patterns across developed markets: the stock bond correlation tends to be high during periods when inflation and real returns on short-term bonds, and the uncertainty surrounding them, are high.

Third, we find that while the effect of correlation changes alone on multi-asset class portfolios is large, time-variation in stock and bond volatility can substantially reduce the impact of the stock-bond correlation.

Fourth, bond risk premia are positively correlated with estimates of the stock-bond correlation as implied by the CAPM.

In short, the correlation between stocks and bonds can significantly fluctuate over time. Factors such as inflation and real returns on short-term bonds, along with the associated uncertainty regarding inflation, play pivotal roles in determining both the direction and strength of the stock-bond correlation.

Let us know what you think in the comments below.

References

[1] Molenaar, Roderick and Senechal, Edouard and Swinkels, Laurens and Wang, Zhenping, Empirical evidence on the stock-bond correlation (2023). https://ssrn.com/abstract=4514947

Great article.

I think in today’s world it is getting harder and harder to find assets that are not correlated and stay uncorrelated.

During the 2007 meltdown, many investors learned that asset correlation is a living thing that can change, and uncorrelated assets can become correlated exactly when you don’t want it to happen (during a market crash).

It tells me as an investor not to have too much faith in the correlation that I observed during good economic times.